oracle 1z0-1055-21 practice test

Oracle Financials Cloud: Payables 2021 Implementation Essentials Exam

Last exam update: Apr 14 ,2025

Question 1

You have created an approval rule as follows:

Rule 1: If the invoice amount > $1000, route it to User 1.

Rule 2: If the invoice amount < $1000, auto approve it.

Now, the user creates an invoice for $1000 and routes it for approval.

What will happen?

- A. Invoice will be auto-approved.

- B. The workflow will fail once approval is initiated.

- C. The initiate option is greyed out for the invoice.

- D. Invoice will be sent to User 1 for approval.

Answer:

B

Question 2

A company has three legal entities each with a corresponding business unit all within the same

country. All organizations buy and sell the same products. You are configuring the tax setup.

What is the minimum number of Tax Regimes you need to configure for this company?

- A. 2

- B. 6

- C. 1

- D. 3

Answer:

D

Explanation:

You must set up a separate tax registration to represent each distinct registration requirement for a

first party legal reporting unit.

Reference:

https://docs.oracle.com/cd/E25178_01/fusionapps.1111/e20375/F527690AN1AA76.htm

Question 3

The Government has introduced a new reduced tax recovery rate for certain services. You need to

amend the configuration for your current tax regime to reflect this change.

Which three setups will you need to complete? (Choose three.)

- A. Setup a new tax

- B. Setup a new tax rate

- C. Setup a new recovery rate

- D. Setup a new tax rule

- E. Setup Determining Factor and Condition Sets

- F. Setup a new status

Answer:

B, D, F

Explanation: Set up details for the taxes of a tax regime. Each separate tax in a tax regime includes

records that are used to calculate and report on the tax, including:

Tax statuses

Tax rates

Tax rules

Reference:

https://docs.oracle.com/en/cloud/saas/financials/20b/faitx/tax-configuration.html#FAITX1843284

Question 4

During an expense audit the auditor marks an expense item that is missing a receipt to be Short Paid.

They choose to complete the audit and warn the user.

Given that the Expense Report Audit Approval is set to After Manager Approval, what two are valid

results of the auditor action? (Choose two.)

- A. New expense report containing disallowed expense items is immediately created.

- B. Approved part of the expense report is not eligible for expense reimbursement.

- C. The approved part of the expense report is eligible for expense reimbursement.

- D. New expense report containing disallowed expense items is not created until manager approves the short payment.

Answer:

A, B

Explanation:

New expense report containing disallowed expense items is immediately created.

Expense report isn't eligible for expense reimbursement.

Reference:

https://docs.oracle.com/en/cloud/saas/financials/20b/fawde/expense-report-audit.html#FAWDE1119039

Question 5

A Payables user creates a manual invoice and a Withholding Tax Classification Code defaults on the

invoice line when the invoice is saved.

Where does this Withholding Tax Classification Code default from?

- A. From the Party Tax Profile of the Third Party Site

- B. From the Manage Tax Reporting and Withholding Tax Options

- C. From the Income Tax region of the Supplier

- D. From the Site Assignments of the Supplier Site

Answer:

B

Explanation:

Set withholding tax options on the Manage Tax Reporting and Withholding Tax Options page and on

the supplier setup.

Reference:

https://docs.oracle.com/en/cloud/saas/financials/20b/faipp/payables-tax-and-withholding.html#FAIPP206035

Question 6

You are evaluating the predefined expense report approval rules within your test environment to see

if they meet current business requirements.

Which three rule sets are part of the predefined setup? (Choose three.)

- A. Approval by Cost Centre owners in parallel or serial mode

- B. Approval by supervisor based on expenses type amount

- C. Approval by Project Manages in parallel or serial mode

- D. Approval by supervisor based on report amount

- E. Approval by a Group based on report amount in parallel or serial mode

Answer:

A, C, D

Explanation:

Approval by cost center owners in parallel mode

Approval by cost center owners in serial mode

Approval by project managers in parallel mode

Approval by project managers in serial mode

Approval by supervisor based on report amount

Reference:

https://docs.oracle.com/cd/E15586_01/fusionapps.1111/e20375/F569964AN58859.htm

Question 7

Your client wants the subledger journal entry description to be transferred to general ledger.

Which two could be used to enable this? (Choose two.)

- A. Set the General Ledger Journal Entry Summarization option to Summarize by general ledger period

- B. Set the General Ledger Journal Entry Summarization option to Group by general ledger period

- C. Set the General Ledger Journal Entry Summarization option to Group by general ledger date

- D. Set the General Ledger Journal Entry Summarization option to Summarize by general ledger date

Answer:

A, D

Reference:

https://docs.oracle.com/en/cloud/saas/financials/20b/faisl/subledger-accounting-setup.html#FAISL1025380

Question 8

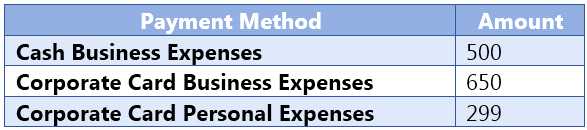

You use corporate cards with expenses and have implemented the Company Pay payment option. An

employee incurred the following expenses.

What is the resulting payment amount made to the employee for these expenses?

- A. 1449

- B. 201

- C. 949

- D. 500

Answer:

C

Explanation:

Company Pay: Your company pays the corporate card issuer for all transactions.

Reference:

https://docs.oracle.com/en/cloud/saas/financials/20b/faiex/credit-card-data.html#FAIEX166577

Question 9

Which two invoice types can have a status of Incomplete? (Choose two.)

- A. Supplier Portal Invoices which are rejected and resubmitted for approval

- B. Scanned Invoices with incomplete or missing information

- C. Scanned Invoices which are rejected during import

- D. Prepayment Invoices which are fully paid but not applied against any invoice

- E. Supplier Portal Invoices which are saved but not yet submitted

Answer:

A, B

Explanation:

As a Supplier user, you can now edit and resubmit invoices that are rejected from the approval users

during the invoice request approval process.

An incomplete invoice is an invoice created from an image that has invalid or missing information.

Reference:

https://docs.oracle.com/en/cloud/saas/financials/21c/fappp/invoices.html#FAPPP114315

Question 10

In the Business Intelligence Publisher (BIP) report layout properties page, when you click Extract

Translation, the BIP publisher extracts the translatable strings from the BIP report template and

exports

them

into

which

format?

- A. .doc (Word file)

- B. .pdf (Acrobat reader file)

- C. .xls (Excel file)

- D. .xlf (XLIFF file)

Answer:

D

Explanation:

BI Publisher extracts the translatable strings from the template and exports them to an XLIFF (.xlf

file).

Reference:

https://docs.oracle.com/cd/E29542_01/bi.1111/e22255/translations.htm#BIPAD377

Question 11

When working with reference data sets in Payables, what reference data sharing method can you use

for Payables Payment Terms?

- A. Assignment to one set only; no common values allowed

- B. Assignment to one set only with common values

- C. Assignment to multiple sets with common values allowed

- D. Assignment to multiple sets; no common values allowed

Answer:

D

Explanation:

Assignment to multiple sets, no common values allowed. The method of sharing reference data that

allows a reference data object instance to be assigned to multiple sets. For instance, Payables

Payment

Terms

use

this method.

Reference:

https://docs.oracle.com/en/cloud/saas/financials/20b/faigl/reference-data-sharing.html#FAIGL462453

Question 12

Which two tools can you use to build layouts for BI Publisher reports? (Choose two.)

- A. Report Developer

- B. BI Composer

- C. Template Builder for Word

- D. Layout Editor

- E. BI Answers

Answer:

A, D

Explanation:

Oracle BI Publisher report development requires specialist developer resources to build / modify the

XML layout designs.

layout editor Helps you to easily create report layouts directly in a web browser or with familiar

desktop tools, such as Microsoft Word, Microsoft Excel, or Adobe Acrobat.

Reference:

https://www.enginatics.com/blog/how-to-quickly-create-or-modify-oracle-e-business-

suite-bi-publisher-based-reports/

https://dataterrain.com/advantages-of-oracle-bi-publisher/

Question 13

Your client wants to retrieve values for the account code based on the invoice line description. For

example, Invoice Line Description = Laptop then Account Code = 5670.

Which Subledger Accounting option would you use to achieve this?

- A. Mapping Set

- B. Description Rule

- C. Supporting References

- D. Event Class Settings

- E. Transaction References

Answer:

B

Explanation:

If you're matching to a purchase order and don't enter a value, the import process uses the item

description from the purchase order line.

Reference:

https://docs.oracle.com/en/cloud/saas/financials/21a/fappp/invoices.html#FAPPP592120

Question 14

You need to have your invoice line automatically distributed across multiple cost centers. For

example, you want your monthly utility bill allocated across multiple cost centers based on a

percentage.

Which two are valid methods to achieve this? (Choose two.)

- A. Choose the 'All Lines' option from the Allocate menu in the invoice line area.

- B. Define a distribution set and assign it to the supplier.

- C. Define a distribution set and assign it manually to the invoice.

- D. Define a payment term and assign it to the invoice.

Answer:

C, D

Question 15

There are four key reports in Cash Management.

What is the correct match for each report and its description?

Report

1. Cash to General Ledger Reconciliation Report

2. Bank Statement Report

3. Cash in Transit Report

4. Bank Statement Analysis Report

Description

1. Lists all transactions for a specific bank account, that have been remitted to the bank but have not

been cleared.

2. Displays the bank statements that are used to analyze balances and transaction details.

3. Displays balance and transaction information for specific bank statements.

4. Lists bank statement transactions that are accounted in GL but are not reconciled in Cash

Management.

- A. 1 = H, 2 = G, 3 = E, 4 = F

- B. 1 = E, 2 = G, 3 = H, 4 = F

- C. 1 = H, 2 = F, 3 = E, 4 = G

- D. 1 = H, 2 = E, 3 = G, 4 = F

Answer:

C

Reference:

https://docs.oracle.com/en/cloud/saas/financials/20b/ocuar/oracle-fusion-cash-management-reports.html#OCUAR1440972